CreditMate

.jpg)

Overview

Google Certification Project - June 2024. First project in the Google Certification program to learn and advance current knowledge of Figma for phone applications.

The Problem

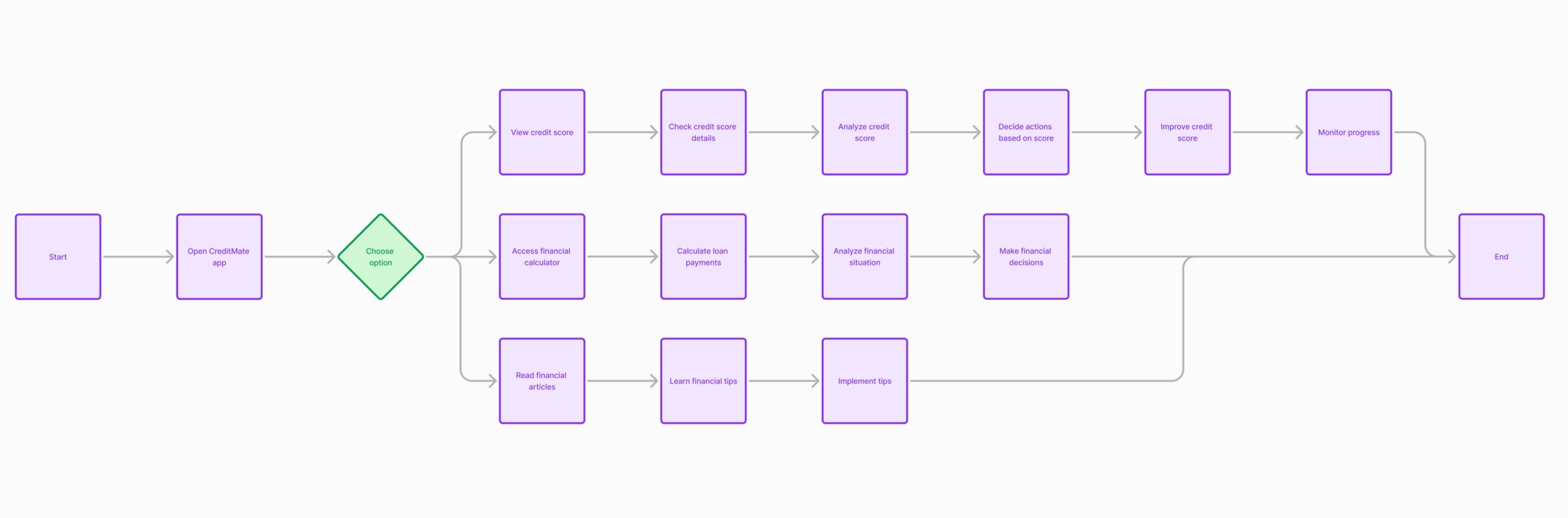

Users often have to manage financial data from multiple sources — credit score apps, calculators, financial articles — leading to confusion and inefficiency.

Solution

CreditMate helps users better manage their finances, improve their credit health, and become more financially empowered.

Key Features

- Easy-to-read credit score visualization.

- Breakdown of factors affecting the credit score (e.g., payment history, debt levels, credit length).

- Credit score trends over time with improvement tips.

- Loan affordability and mortgage calculator.

- Credit card interest calculator.

- Savings and investment growth calculator (e.g., compound interest, retirement).

- KArticles on improving credit score, managing debt, building savings, and investing.

- Categorized content tailored to the users financial profile.

- Push notifications for new articles and tips based on user behavior.

- Accessibility features

- Key functionality or benefit

- Personalization aspects

- Data insights provided

- Long-term user value

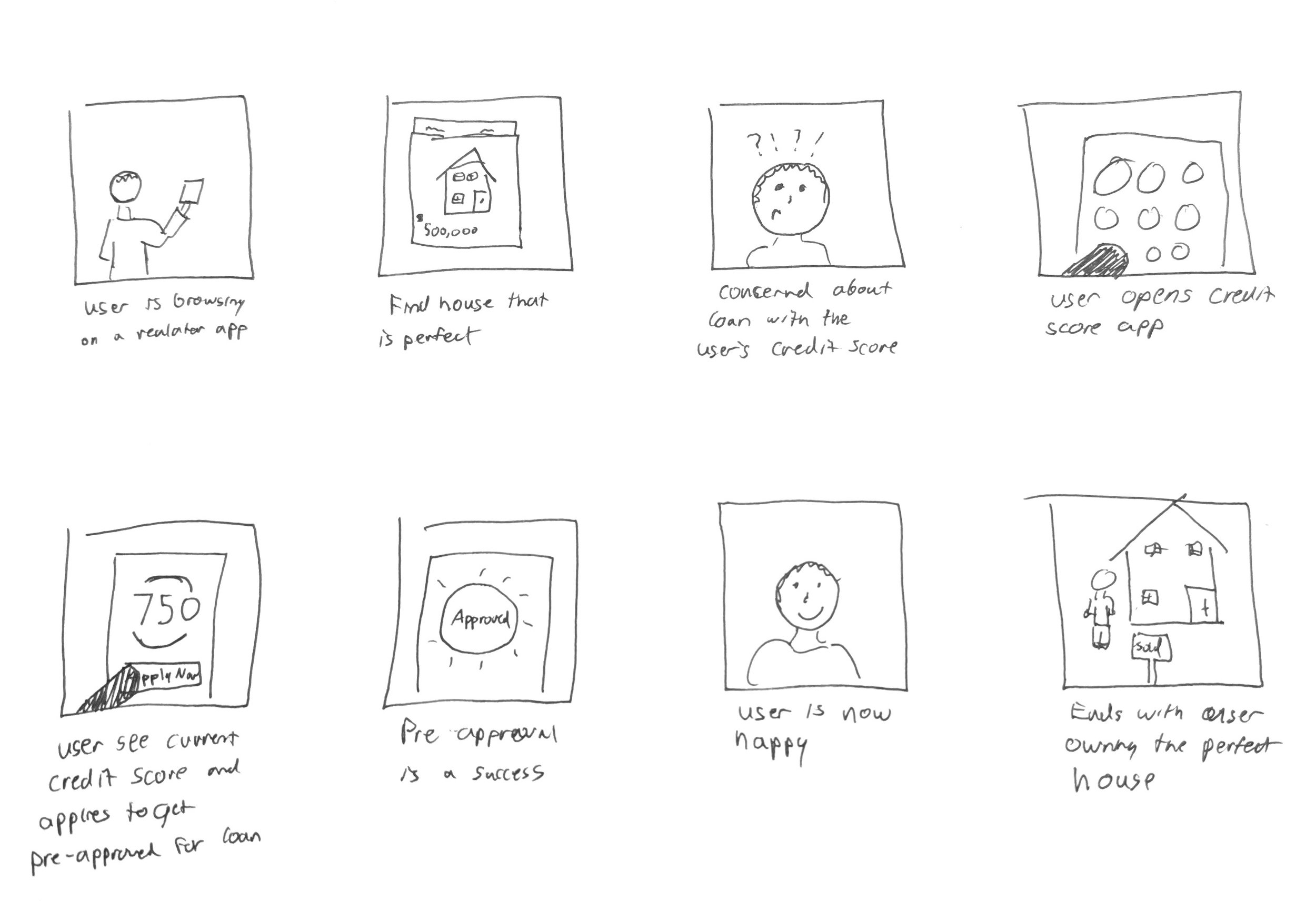

Understanding the User

Individuals seeking to improve financial literacy, track their credit score, and manage personal finances effectively.

Young adults, new credit card holders, or anyone seeking financial guidance.

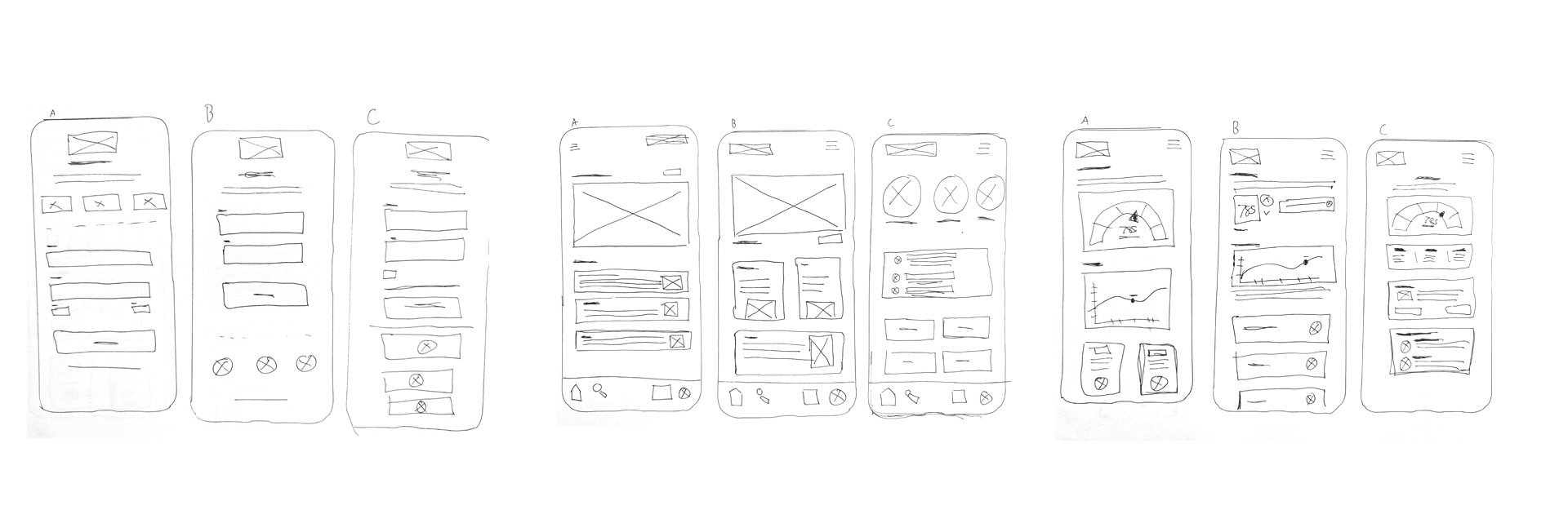

Wireframes

The app should present complex financial data in an easy-to-understand format. Clean, minimal UI with intuitive navigation.

Clearly communicate financial health and impacts of actions without confusing jargon.

Tailor content, calculators, and recommendations to the user’s specific financial profile.

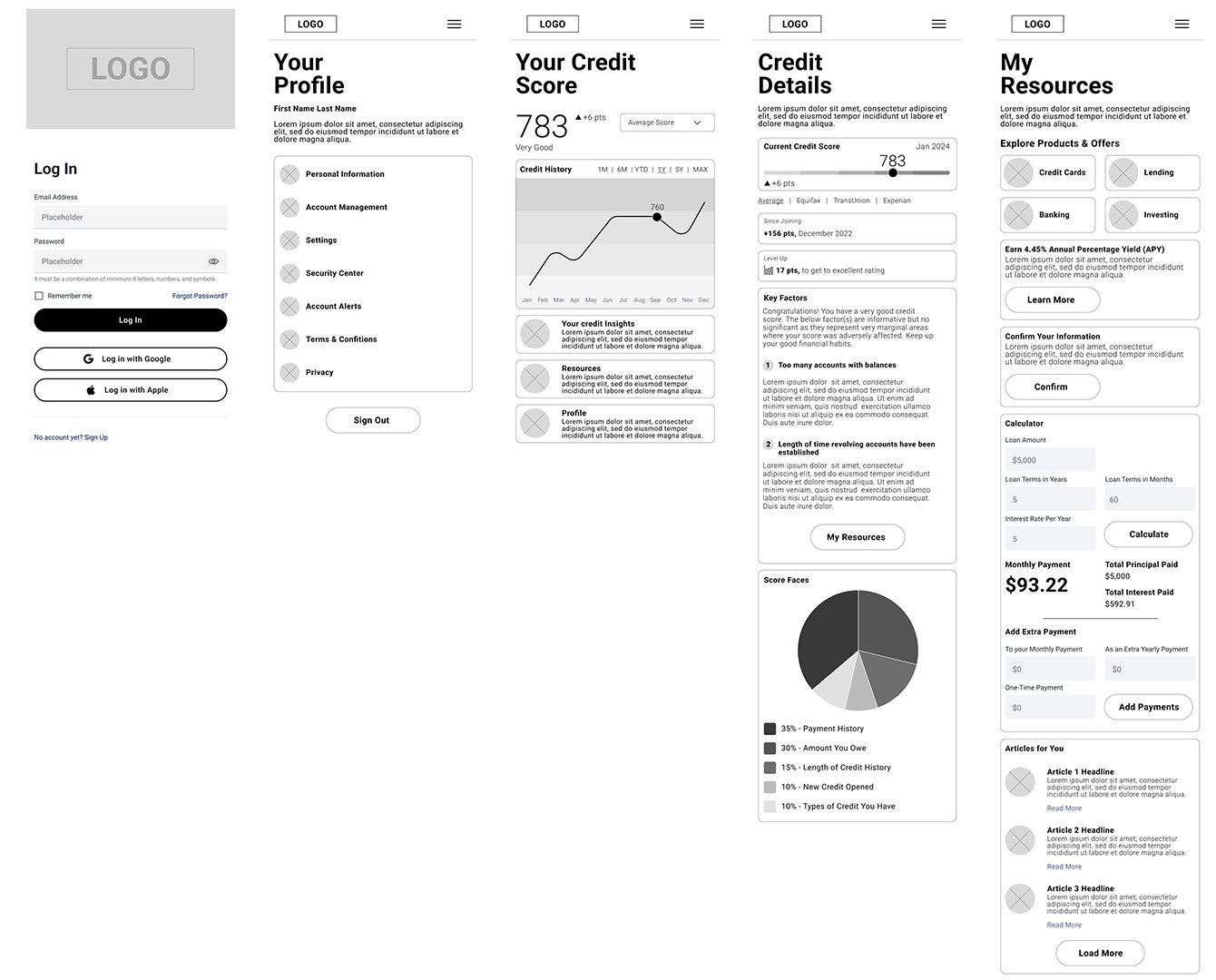

Usability Test

In this usability test for CreditMate, participants were asked to complete tasks such as checking their credit score, using the loan calculator, and reading a personalized financial article. We observed how easily users navigated these features and identified any pain points or areas of confusion. Feedback on ease of use, clarity of information, and overall experience was collected through a post-test survey

- Ease of Navigation: Most users found the app’s layout intuitive and appreciated the clean, organized design of the dashboard.

- Clear Credit Score Display: Users liked the real-time credit score feature, finding it easy to access and understand, with useful breakdowns of factors affecting their score.

- Helpful Calculators: The financial calculators, especially the loan and debt consolidation tools, were praised for being simple to use and providing clear, actionable results.

- Confusion in Financial Articles Section: Some users felt that the articles were not well categorized, making it difficult to find specific topics.

- Lack of Real-Time Notifications: Users suggested that the app could benefit from more proactive notifications for credit score changes and upcoming bill reminders.

High Fidelity

.jpg)

.jpg)

Takeaways

- Reinforced the importance of design consistency and the value of wireframing and prototyping in Figma.

- Applied an iterative design process where feedback refined user flows and improved overall usability.

- Leveraged Figma’s collaboration tools to facilitate seamless teamwork and communication.

- Gained hands-on experience balancing usability, consistency, and collaboration in the design process.